Monechron

Tutorials

Lesson

3: Using Web Scout™ to import transactions from

your banks' websites

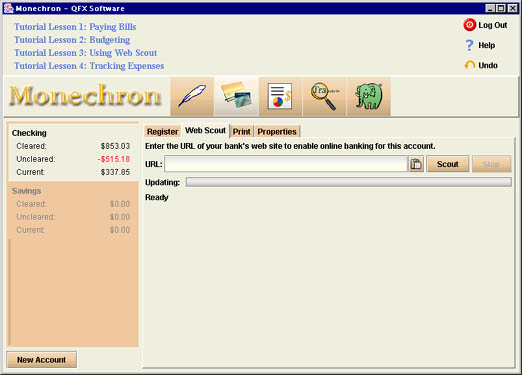

Click on the Accounts

icon and then on Web Scout™, and the screen

should look like this

At this point, if

you've done tutorial Lesson 1

and have written a check on Monechron, you

will see that your bank account is displayed on the left, with the

current balance. If it's an online account, simply click on Scout to

update your account balance. If it's an offline account, go on to

the next section.

Suppose this is the

first time you use Web Scout™, you'll need to

log on to your bank's website to begin scouting. (If you do not have

a User ID and password, you must first log on to your bank's website

from your browser and obtain one, then you can proceed with Web

Scout™.)

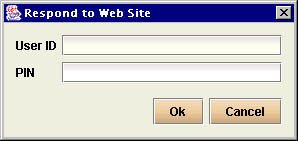

Step1: Enter

your bank's website address after URL, for example, www.anybank.com,

and click on Scout. A dialog box will pop up for you to log on to

your bank's website

Step 2:

Enter your User ID and PIN for your bank's website and click on OK.

You need to do this only once, as a new user of Web Scout™.

(For

your peace of mind, please note: Your User ID and password are

stored only on your computer and are protected by strong encryption.

You are the only one who has access to it.)

It will take a few

seconds for Web Scout™ to access your bank's

website. While you wait, here's an overview of how online banking

works in Monechron. Normally, you balance

your checkbook and reconcile your accounts by hand, which would

involve matching your bank statements against your checkbook

register every month and manually correcting any discrepancies in

the process.

With Web

Scout™ as your "agent", you will never have

to spend time doing everything manually again. The Monechron

register is your personal "checkbook," keeping a

record of all the checks you've written and transactions you've made

in Monechron. And Web Scout™,

every time you click on Scout, will bring an instant, up-to-date

"bank statement" back to you, with a list of the

transactions that have cleared the bank. Web Scout™ will

also compare notes with your "checkbook", reconciling it

with the "bank statement" to give you your realtime

balance. All you have to do is verify the information brought to you

by your "agent" and save it to your register.

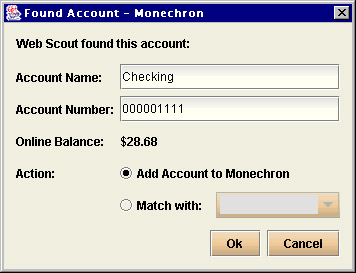

When Web Scout™

finishes updating, another dialog box will pop up

Step 3: Your

accounts with the bank will appear in the dialog box. From the

dropdown list select the appropriate action: Add it if it's a new

account; Match with: if the account is already listed in Monechron,

and click on OK. Each account will be saved.

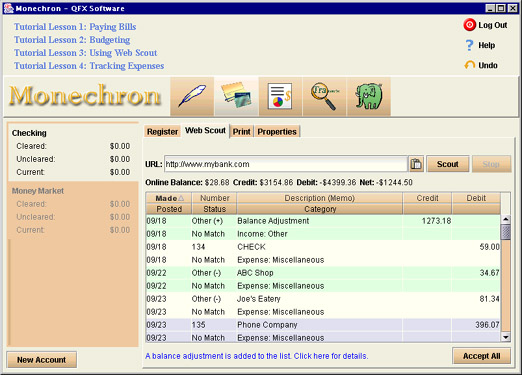

Step 4: Next,

click on any of the accounts you've just saved, and the reconcile

screen will show

A list of the

transactions that have recently cleared your bank should be

displayed here. Each transaction should be marked as Matched,

Mismatched, or No Match. A Matched transaction means

that the bank's record matches exactly the same one in your Monechron

register. A Mismatched transaction means that a discrepancy

in amount exists between the bank's record and your record. A No

Match transaction means that the bank has recorded the cleared

transaction but it is not found in your register.

Step 5: In case

of a Mismatch, check for errors. Click on the mismatched transaction

and a dialog box will pop up for you to make corrections to the

transaction in your register.

Step 6: Once

you've fixed the mismatches, simply click on Accept All. Your

account is now automatically reconciled.

Your credit card

transactions brought to you by Web Scout™ are

categorized by default as Miscellaneous. In order for a credit card

payment to be recorded correctly as expense, select from the

dropdown list Transfer so the credit won't be treated as your

income. Also, when you write a check to pay your credit card bill,

you should categorize it as Transfer.

For other transactions,

click on the dropdown list after each transaction to categorize it.

Then click on Accept All. Once you've categorized a payee, for

example, categorizing Bob's Fried Chicken as Dining, all subsequent

charges at Bob's will be automatically labeled as Dining.

To make

tracking/budgeting more accurate, you should categorize all

uncategorized transactions.

After you've added the

accounts you wish to operate in Monechron,

all you need to do later is select any of the accounts you want to

update and click on Scout. Web Scout™ will bring

to you a new list of transactions that have cleared your bank, with

each marked as Matched, Mismatched, or No Match. Click on Accept All

after you verify the information, and your "checkbook" is

balanced. It is just as easy as that!

If you wish to convert

an offline account to an online account, enter the URL of the bank's

website and click on Scout. The rest is the same as described in Section

3.1.

For questions, email support@qfxsoftware.com,

or go to the User Manual for a more

detailed description of Web

Scout™ features.

Previous Top

Previous Top

Next

Next  |